The best car insurance blog 7077

AboutTop Guidelines Of How Will Your Social Security Benefits Stack Up To The ...

A small company policy with a $1 million/$2 million aggregate, will typically cost more than a policy with a $1 million/$1 million aggregate. An aggregate limitation is the most an insurance coverage company will pay toward a claim throughout a policy term.

These protection levels generally can be adapted to satisfy your particular requirements, and they affect your last rate. These three elements represent the fundamentals, and every small organization owner ought to be familiar with them. Obviously, there are other aspects that can affect your organization insurance expenses including: Residential or commercial property Equipment Place Time in company And more There's a lot to think about when insuring your company, but getting aid is simple.

How Much Is Car Insurance? Fundamentals Explained

It's that basic. More information.

That's a lot of cash. Of course, the typical consumer isn't buying a brand-new vehicle each time they flip a page on the calendar, so the car's cost is amortized over the length of time you own the vehicle. According to research study by R.L. Polk, the average length of time motorists will keep a new vehicle is 71.

Rumored Buzz on How Will Your Social Security Benefits Stack Up To The ...

91 additional per month. If, on the other hand, you only have reasonable credit (620-659), you can anticipate a rate of interest of around 13. 58% each year. It would bring your total costs approximately $13,894 in interest over 60 monthsan average of $194. 59 per monthand $2,335 each year, for the automobile's lifetime.

91Annual Interest Cost on a 60-Month Loan (Outstanding Credit): $454. 92Monthly Interest Expense on a 60-Month Loan (Fair Credit): $194.

Top Guidelines Of Car Insurance - Aaa Auto Insurance Quotes

If you are in a vehicle mishap, you will be responsible for the deductible to get your lorry repaired. If you do not have the correct coverage for the accident at hand, you will be responsible for the total. Don't forget traffic violations and the costs that occur with them.

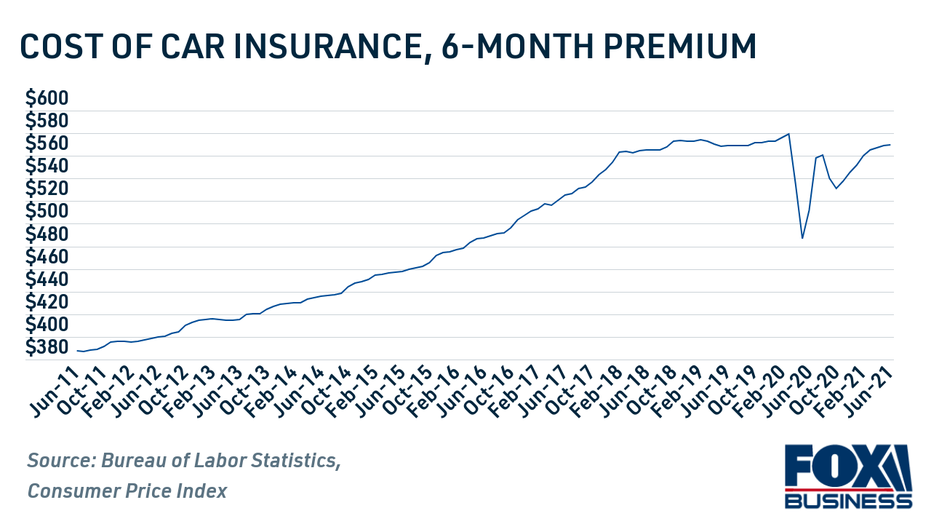

Average Monthly Expense of Automobile Insurance: $132. 6 Average Annual Cost of Cars And Truck Insurance: $1,592 Expense of Gas Gas rates are also extremely variable and can change from day to dayor from one side of the highway to the other. It's difficult to anticipate how much gas costs will change properly, but in the previous five years, the U.S.

The Ultimate Guide To The Last 2 Child Tax Credit Payments Are Fast Approaching ...

87 and $2. 99 per gallon. Assuming that an "average year" is somewhere in between, let's presume you can anticipate to pay around $2. 00 per gallon of gas. A lot more essential than the price of gas is the gas mileage of your particular car and how much you drive in a given month.

Taking public transit and using rideshare services like Uber or Lyft can be a big expense conserving. Think about all of your choices and Helpful site the full scope of the scenario before going all-in on buying a cars and truck.

An Unbiased View of Average Cost Of Car Insurance (October 2021) - Valuepenguin

For existing policyholders, contact us to add your non-Tesla cars to your policy. You can make online payments with a debit or charge card. Tesla will automatically charge each month-to-month premium payment to this card. Depending on the state, charges are usually added to the very first payment. All fees are non-refundable in the event of cancellation.

Usually, a car is a total loss when the repair work cost plus the expected salvage worth is higher than the market worth of the car. In some states, a vehicle might be a total loss if the repair work expenses exceed a percentage of the lorry's value. Your adjuster will assist determine if your lorry is a total loss and will serve as your main contact for questions or concerns.

Monthly Or Annual Auto Insurance Premium: Which Is Best For ... - Truths

This procedure is referred to as subrogation. Depending upon the scenarios of your claim, it is common for it to take a number of months to reach a settlement with the party responsible and/or the insurance company. If Tesla's Recovery Department successfully recuperates any cash, your deductible will be refunded in part or entire based upon the recuperated quantity and/or local laws.

It's tough to think that it's already September! People from all over bring the traditional and collector vehicles to show off.

Monthly Car Payment Calculator - Allstate Can Be Fun For Everyone

Classic vehicles offer us a peek of days passed. For those who own these fascinating bits of history, their vintage cars have amazing worth. Owners of vintage cars like to share their treasure with others and delight in driving their collector's item to automobile programs or occasionally out for a Sunday afternoon drive.

You are far less likely to submit a claim on your timeless vehicle than your everyday auto. Traditional automobiles are guaranteed based on the agreed-upon value of the vehicle.

The Ultimate Guide To Car Insurance Rates By State For 2021 - Coverage.com

You will require to do your due diligence to identify what your car deserves. After doing your research study, you determine your car's value to be $5,000. Next, you call your insurance agent and tell them the worth of your vehicle and offer them with some pictures and information about your cars and truck.

The majority of traditional car insurance coverage business are specialists on these types of cars. Let's state the insurance coverage business concurs that your automobile is worth $5,000.

The Ultimate Guide To How We Calculate Auto And Car Insurance Premiums - Usaa

Here are the 3 most significant differences in these types of policies. The greatest difference in between classic automobile insurance and routine car insurance coverage is that timeless automobile insurance coverage, as we talked about above, is based on the worth of the automobile. With routine car insurance coverage, the insured automobile is guaranteed on the real value of the car.

Practically it looks like this. Let's say you have a classic automobile that is valued at $40,000. That implies that both you, the owner, and the insurance provider have concurred that the value of the car is $40,000. Now, let's say that your car is in a mishap and is amounted to.

Not known Facts About How To Figure Out The Cost Of Car Insurance Per Month - Jerry

Now let's say that you have a 2018 Ford Mustang that you purchase for $40,000, If this car is in a mishap and is totaled, the insurer would figure out the amount you would be paid according to what the vehicle is worth at that time. The insurance coverage company would give you the quantity your mustang was worth at the time of loss.

https://www.youtube.com/embed/HWvIvE_0bZU

In reality, the car may not even be driveable. For many people, restoring their vintage car is one of the best parts of the experience. In time, the owner makes enhancements to the vehicle. Maybe they change worn or damaged parts with initial parts. Possibly they reupholster the back seat.

AboutIndicators on How Do I Lower My Car Insurance? - The Drive You Need To Know

If you have an active policy with another carrier and receive a quote from us a minimum of 7 days prior to the policy enters into impact you might be eligible for our early-bird discount rate. If you have actually been a devoted American Family consumer for a while, we think you be worthy of a discount rate.

Bundle your policies and save You may have heard the term "bundling" when it concerns insurance coverage. But what is bundling!.?. !? It's really among the easiest ways you can minimize your insurance coverage premium! Bundling is when you buy several insurance products with the same company, like your auto and house, automobile and renters, and even your auto and life insurance.

How Nine Ways To Lower Your Auto Insurance Premium can Save You Time, Stress, and Money.

Just ask your representative to see if you're qualified. Take advantage of Automobile, Pay Automobile, Pay is another effortless method for you to save money on your vehicle insurance coverage premium and it even assists you prevent late payment costs. With Vehicle, Pay, your payments will be automatically deducted from your checking or cost savings account.

The steps are easy to follow and it only take a few minutes. Here's how paperless billing works. Pay completely Wish to shave some major dollars off your cars and truck insurance premium? American Household provides a full-pay discount rate when you pay your policy completely at the time of purchase.

The Main Principles Of How To Lower Your Car Insurance Rates Even After An Accident

Your insurance coverage representative can work with you to assist you identify the finest protections for your requirements. Taking the time to do some research, asking your agent questions and knowing what you're paying for on your policy can help lower how much you pay for cars and truck insurance coverage.

Compare insurance coverage expenses prior to you buy a vehicle Among the elements taken into consideration when figuring out a vehicle insurance premium is the worth of your car, the expense to repair it, the possibility of theft and its security record. So believe about how the type of car you buy could affect your car insurance coverage rate.

Fascination About 6 Ways To Lower Car Insurance Costs - Virginia Credit Union

Store around, get automobile insurance coverage quotes and don't be afraid to call up the business and ask what kind of discount rates you could get. The finest method to conserve money on your automobile insurance premium is by being notified and asking concerns.

Do you know that the typical chauffeur has not switched his/her car insurance coverage provider for over 12 years? If you think that your vehicle insurance company is going to hand you a discount for loyalty, you 'd be misinterpreted. Car insurance coverage suppliers hardly ever approach you with a discount, even if your driving situation has actually considerably improved throughout the years.

9 Easy Facts About 5 Things You Can Do To Lower Your Auto Insurance Rates Explained

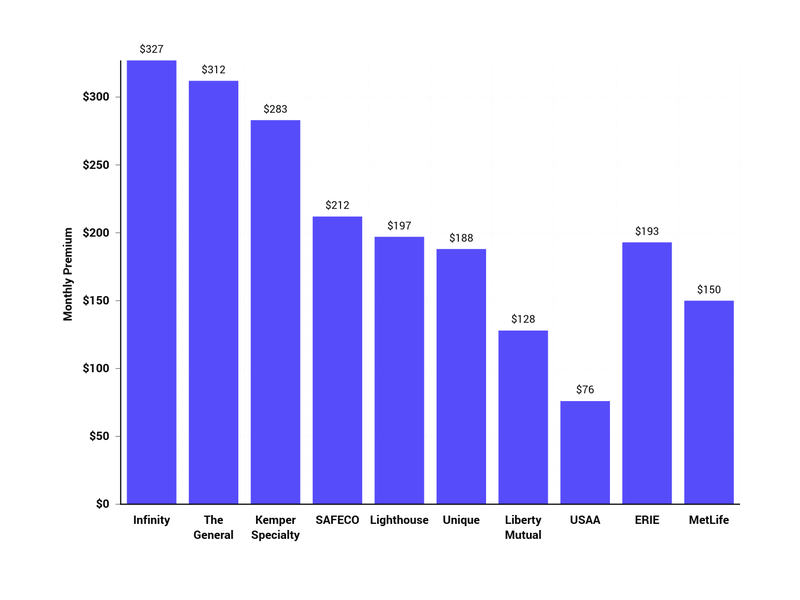

Statistics show that the typical cars and truck insurance expense is around $1,512 a year, or a regular monthly premium of $126. The exact rate that you'll pay will depend on a number of factors (including what state and city you live in, your age, and even your credit history) if you find yourself paying much more than the national average, it's time to begin browsing for a brand-new rate.

Step 1: Request For a Higher Deductible The deductible is the amount that you are expected to from an at-fault accident before your insurance "kicks in" to bear the cost. As a general rule, the more you pay in a regular monthly premium, the lower your deductible will be in the event that you're associated with an accident.

6 Ways To Lower Car Insurance Costs - Virginia Credit Union Fundamentals Explained

If it's been a few years given that you went shopping for insurance coverage, protect at least three quotes from competing insurance coverage business and see how they compare to your existing rate. If you're satisfied with your present insurance coverage company's services but you have actually still found a quote for a lower rate, Insurance service providers understand that it's much riskier to extend coverage to a brand-new chauffeur than it is to keep an old one, and the finest vehicle insurance coverage business often provide to match or beat the rates of their rivals if they capture wind that you're believing about making a switch.

Contact your insurance service provider and tell them that you are considering including your house or renter's insurance coverage to your existing automobile insurance package and ask about any discount rates you can protect by bundling. Step 4: Improve Your Credit Rating Though the majority of drivers aren't keen on the practice, automobile insurance companies greatly factor your credit score into the calculation of your premium.

More About How To Lower Your Car Insurance (Just 4 Easy Steps) - Ramit ...

Step 6: Install an Anti-Theft Gadget Lots of insurance provider offer or who have actually aftermarket anti-theft systems installed. If you have comprehensive auto insurance coverage in addition to basic crash insurance coverage, you may have the ability to conserve even more. Contact your insurance supplier and inquire about premium discounts for anti-theft device setup.

The more quotes you find, the better your opportunities are at securing the very best possible rate, so make certain to speak with a minimum of 3 insurer prior to you sign on. Do you use discounts for insurance coverage packages or packages? What kinds of discounts am I eligible for? What is my threat assessment? How did you reach this number? What aspects do you utilize to identify a quote? Do you have a physical workplace where I can consult with you to discuss my policy options? How much would this exceptional increase if I were to move? What if I were to add another driver to my policy? If my automobile insurance coverage supplier charges a fee for stopping coverage before the terms of my policy, will your business aid to cover this expense if I switch to you? Getting the very best Vehicle Insurance Rate Whether you're getting guaranteed for the first time or you're considering changing insurance service providers, you need to leave yourself prior to you require to make an option.

The 9-Second Trick For 5 Ways To Help Lower Auto Insurance Rates - Military.com

There's nothing worse than signing up for a brand-new, less pricey policy only to find that your insurance does not cover all of the threats you need. Related Link:.

https://www.youtube.com/embed/eIgKgBdPphk

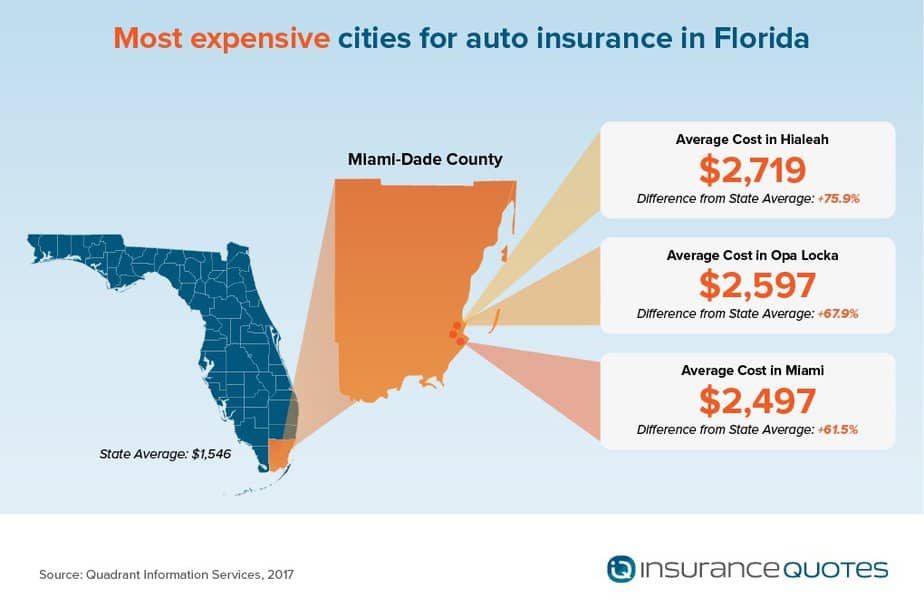

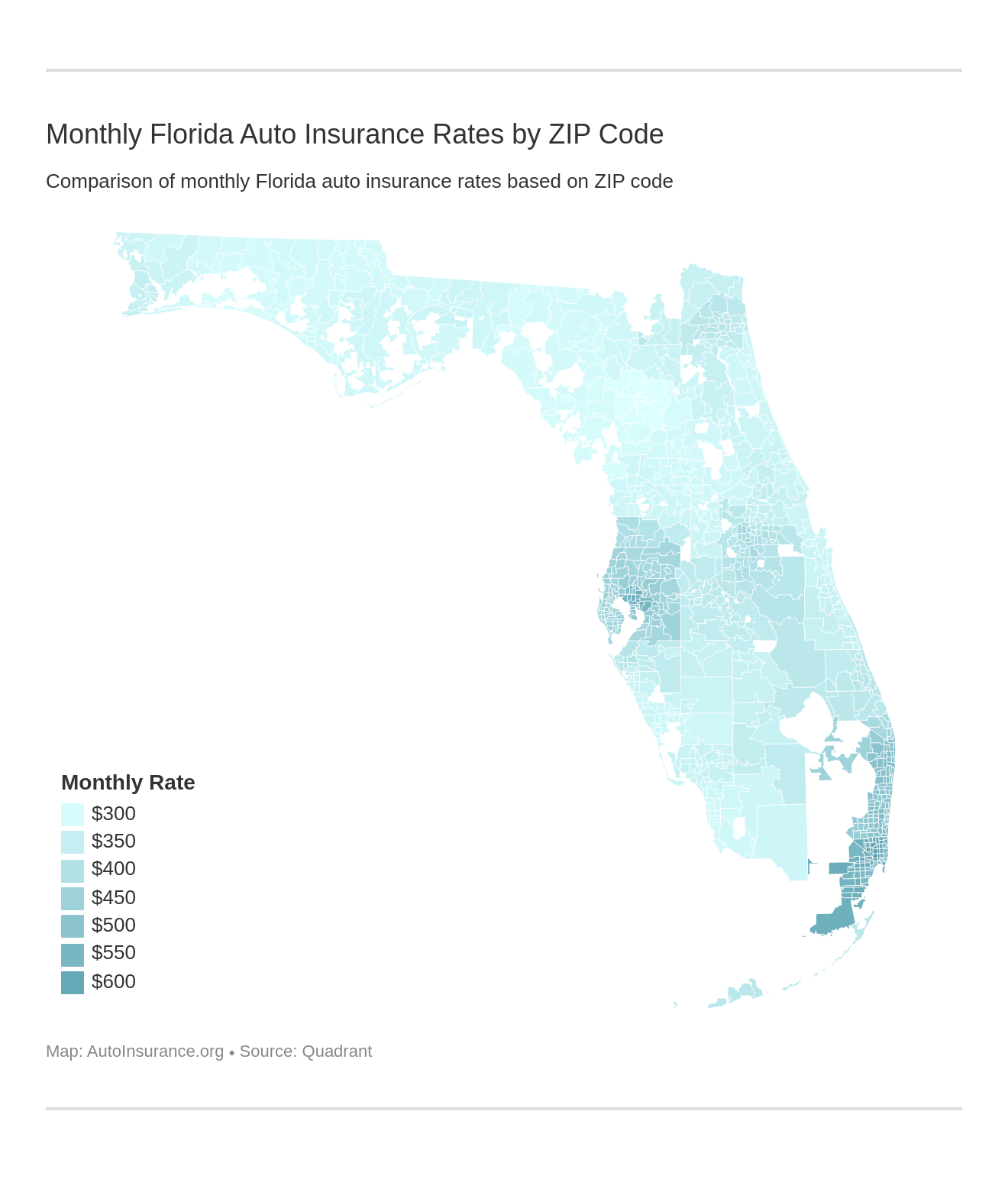

Depending on where you live in the States, auto insurance costs can end up being really costly., we found that the typical vehicle insurance in Michigan costs more than $3,100 for a complete protection policy.

AboutThe smart Trick of Top 10 Tips When Adding A Teenager To Car Insurance That Nobody is Discussin

If you're not currently paying for all your insurance needs under one carrier, you might think about making the switch to combine and conserve! Compare Main and Secondary Driver Costs Once you add a teen to your policy, they'll be assigned as a main or secondary driver to the cars you own.

All three need to be noted on your policy. In this scenario, if you have 3 or more cars and trucks, an insurance representative will immediately appoint your teenager as the primary driver of one car. To save cash, ask your agent if you can make your teen the main chauffeur of the automobile that is least pricey to insure.

Note: You can't be a main motorist for two automobiles unless you have more cars than individuals. Impose the Significance of a Clean Driving Record, Great chauffeurs are rewarded by insurance coverage business.

When Do Car Insurance Rates Go Down? for Dummies

The more knowledge and skills they have, the better motorist they'll be! Indication Your Family Up for a Defensive Driving Course Your teen isn't the only family member who can take drivers ed.

10. Think Carefully About Raising Your Deductible Do you have money conserved away for an emergency? If so, you may wish to think about raising your deductible (the cash you need to pay in case of a mishap prior to insurance coverage starts). Doing so would decrease your month-to-month costs, however is not advised unless you have an emergency situation fund set up.

Vehicle insurance doesn't have to be costly with a teenager behind the wheel. There might be a lot more discount rates readily available to you and your family when it comes to vehicle insurance coverage. Every insurer has various policies and prices, and state laws can affect those as well, so be sure to go over alternatives with your agent.

How At What Age Do Car Insurance Rates Begin To Decrease? can Save You Time, Stress, and Money.

She loves using her passion for writing and tracking marketing trends to help Aceable's trainees discover required abilities to succeed in their lives and professions.

Automobile insurance coverage is needed to protect you economically when behind the wheel.!? Here are 15 methods for saving on cars and truck insurance costs.

Lower automobile insurance rates may also be available if you have other insurance coverage with the exact same company. Keeping a safe driving record is key to getting lower automobile insurance rates. Just How Much Does Automobile Insurance Expense? Vehicle insurance coverage expenses are different for every single motorist, depending upon the state they reside in, their option of insurance company and the kind of coverage they have.

How Teen Driving - Auto Coverage From National General Insurance can Save You Time, Stress, and Money.

The numbers are relatively close together, suggesting that as you budget for a new automobile purchase you may need to consist of $100 approximately each month for car insurance. Note While some things that affect automobile insurance coverage rates-- such as your driving history-- are within your control others, expenses may likewise be impacted by things like state guidelines and state accident rates.

Once you understand how much is cars and truck insurance coverage for you, you can put some or all of these techniques t work. 1. Benefit From Multi-Car Discounts If you obtain a quote from an automobile insurance provider to insure a single vehicle, you might end up with a higher quote per automobile than if you asked about insuring numerous drivers or vehicles with that company.

If your child's grades are a B average or above or if they rank in the top 20% of the class, you might be able to get a excellent student discount rate on the coverage, which usually lasts up until your kid turns 25. These discounts can vary from as little as 1% to as much as 39%, so make sure to show proof to your insurance coverage agent that your teen is an excellent student.

A Biased View of How Much Does It Cost To Add A Teenager To ... - Creditdonkey

Allstate, for example, offers a 10% cars and truck insurance discount and a 25% property owners insurance coverage discount rate when you bundle them together, so examine to see if such discount rates are readily available and suitable. 2. Pay Attention on the Roadway In other words, be a safe chauffeur. This need to go without saying, but in today's age of increasing in-car distractions, this bears pointing out as much as possible.

Travelers offers safe chauffeur discount rates of in between 10% and 23%, depending on your driving record. For those uninformed, points are generally evaluated to a chauffeur for moving violations, and more points can lead to higher insurance premiums (all else being equivalent).

Make certain to ask your agent/insurance business about this discount rate prior to you register for a class. After all, it is very important that the effort being used up and the cost of the course equate into a huge enough insurance savings. It's likewise essential that the chauffeur register for a certified course.

The Definitive Guide for How Much Does It Cost To Add A Teenager To Car Insurance?

4. Look around for Better Automobile Insurance Rates If your policy is about to restore and the yearly premium has gone up markedly, think about searching and acquiring quotes from contending business. Every year or two it probably makes sense to acquire quotes from other business, just in case there is a lower rate out there.

That's because the insurer's credit reliability must likewise be considered. After all, what good is a policy if the business does not have the wherewithal to pay an insurance claim? To run a check on a particular insurance company, consider examining out a site that rates the financial strength of insurer. The financial strength of your insurer is essential, however what your contract covers is also important, so ensure you understand it.

In general, the less miles you drive your cars and truck per year, the lower your insurance rate is most likely to be, so constantly ask about a company's mileage limits. Use Mass Transit When you sign up for insurance, the business will usually start with a survey.

Some Known Details About 15 Best Ways To Save On Car Insurance For Teens - Women ...

Find out the precise rates to insure the various vehicles you're thinking about before making a purchase., which is the quantity of cash you would have to pay before insurance coverage picks up the tab in the event of a mishap, theft, or other types of damage to the lorry.

https://www.youtube.com/embed/ztdCZFwv3Dc

Enhance Your Credit Ranking A driver's record is certainly a huge aspect in figuring out auto insurance costs. It makes sense that a motorist who has actually been in a lot of mishaps might cost the insurance business a lot of cash.

AboutWhat Does Auto Insurance Premiums Explained - Aaa Mean?

But London motorists might take some convenience in understanding that their automobile insurance costs are 164 (17%) lower than last year. Chauffeurs in these areas saw some of the healthy price drops compared to last year: Manchester and Merseyside - 159 (20%) decline - average premium 646 South West - 53 (13%) decrease - average exceptional 346 Compare automobile insurance prices estimate Other motoring costs growing The news that automobile insurance rates are lower must be invited by chauffeurs.

For more suggestions, take a look at our guide on how to conserve cash on your motor. 'Commitment does not pay' Louise O'Shea, Confused. com CEO, states: "From January there will be some essential changes to the way insurance companies are pricing clients, and the issue is that customers will accept a flat or slightly lower rate and just pick to renew.

The 6-Minute Rule for Prepare For Post-pandemic Auto Insurance Hikes - Autoblog

It is necessary to bear in mind that the FCA judgment doesn't stop insurance companies from increasing your cost completely."Unfortunately, we are also seeing a great deal of other household bills increase, particularly energy, so it's more crucial than ever for consumers to be making cost savings while they can. At the minute, this can be done by searching and minimizing vehicle insurance." * Research carried out by One Survey on behalf of Confused.

Did you just recently begin working from home or are driving a lot less this year? Good news-- your cars and truck insurance coverage rates should go down. The converse is true if you spend a great deal of hours and miles on the roadway due to a long commute, chauffeuring kids around or other reasons you'll pay more for auto insurance.

3 Simple Techniques For California Car Insurance Rates On The Rise - 21st.com

There are other methods, too, for car insurer to determine your annual mileage. Instead of have you tell them, they can monitor your driving efficiency and mileage if you register for among their "pay-as-you-drive" or "usage-based" insurance strategies. We will explain more about those choices, and how to earn extra discount rates, in a bit.

To get yourself of the low-mileage discounts you ought to typically drive under 7,000 or 5,000 miles yearly. Your car insurance coverage rates will be greater if you drive more than 20 miles each method to's data research studies show numerous chauffeurs get low mileage discount rate of 5% or under typically nationally.

25 Factors That Affect Your Car Insurance Rate - Nerdwallet Fundamentals Explained

They will wish to know the number of miles you commute and how numerous days each week. This can help the car insurance company check that it matches with the annual mileage you entered, however also it might help them figure out again just how much of a danger you present. For instance, if you reside in a suburban area of a larger metro area, such as Los Angeles, the base insurance coverage rates tend to be better.

In basic, if you drive more than 20 miles each way to work your car insurance coverage rates will be higher. What is considered low mileage for cars and truck insurance?

Examine This Report on How A Credit Score Affects Your Car Insurance - Consumer ...

To get the best low-mileage discount rates you usually should drive under 7,000 or 5,000 miles annually. Insurance business tend to have vehicle insurance coverage mileage brackets and your rates can be higher or lower based upon where your annual mileage falls. Mileage brackets for cars and truck insurance coverage are simply the internal tier system that cars and truck insurance provider use to figure out if motorists drive an average quantity, or more or less.

Brackets differ but here are some typical ones we rate rates for to reveal how rates increase as yearly mileage goes up. We ran rates for a motorist with complete coverage located in Los Angeles, California and discovered the rates increased based upon these common mileage brackets:5,000 miles or under had finest rates7,500: Up average of 10% from 5,00010,000: Up average of 7% from 7,50012,000: Up average of 4% from 10,00020,000: Up average of 25% from 12,000 Mileage above 20,000 stayed the exact same, 0% boost.

The 45-Second Trick For How Much Does Insurance Go Up After An Accident Detail Guide

The expense of a vehicle insurance plan with 20,000 miles or more driven annually was found to be 36% more pricey than if you drove 5,000 miles or less a year. In our example, the chauffeur with less than 5,000 miles would conserve around $750 compare to the chauffeur that was on the road for 20,000 miles or more.

Under state law, mileage is one of the 3 main factors insurer can utilize, the other 2 being a motorist's security record and years of driving experience. So, if you drive less miles in California, the discount is larger, but likewise if you have high mileage your rates spike upwards.

Indicators on Commissioner Lara Finds Auto Insurance Companies ... You Need To Know

It has a two-part rates system where you have a low month-to-month base rate and then a 2nd per-mile rate. For the base rate factors like your motorist history, age, type of vehicle, credit and length of previous insurance is looked at.

The mileage charges are topped at 250 miles each day (150 in New Jersey), so you will not be charged for miles above that quantity every day. Another per mile insurance provider is Mile Automobile that is just readily available in Oregon, Illinois and Georgia. It claims to conserve motorists 30% to 40% off their current automobile insurance rates.

When Do Car Insurance Rates Go Down? - Allstate Fundamentals Explained

This program is offered in 13 states. There is likewise State Farm's Drive Safe and Conserve with On, Star that tracks your mileage and offers discount rates based on yearly mileage. It does not have a per-mile rate like Metromile and the others listed above, but is more of a tracker of miles to give much better discount rates if you drive less.

Will a usage-based insurance coverage program assist me save? Many insurance business are using usage-based insurance (UBI) for chauffeurs to try out.

Some Of How To Reduce Your Car Insurance Rate

An accident-free record will help you conserve. How to save on vehicle insurance? If you drive a little or a lot of miles a year, the key to finding the finest priced policy for your needs is to look around. If you are driving less annually, then ensure to alert your vehicle insurance provider to the lower annual miles driven and see if at your next renewal your premiums are lowered.

https://www.youtube.com/embed/_RyT_oQ7hq0

Same is true for chauffeurs with higher yearly mileage, look around, that is the best method to find not only more affordable cars and truck insurance coverage rates but to discover an insurer that best fits your requirements. If you don't mind your cars and truck insurance provider monitoring your driving, look into the usage-based programs available and offer one a test drive.

AboutSome Known Incorrect Statements About How To Get Car Insurance For The First Time

That suggests you must have an active policy at the time of the vehicle purchase. You won't have the ability to drive the car house and buy a policy later on that day. It's a liability for a dealership to let you drive away in an automobile that is uninsured, not to discuss, it protests the law.

Do not presume the cars and truck or additional protections will be added immediately-- it's your obligation to inform your insurance company about the vehicle and clarify what coverages you desire. You'll need to sign up the car in the state you reside in within 15 to 45 days, depending upon your state, but won't be able to without the lorry being insured.

If you currently have other coverages such as house owners or renters insurance with a particular insurer, you might get a discount on all your policies when you sign up for used car insurance. The deductible is the amount of cash you 'd have to pay out of pocket in case of a mishap prior to your insurance coverage starts paying.

The Ultimate Guide To Checklist For First Time Car Insurance Buyers

Be sure you can manage the quantity you raise your deductible to. You might take the cost savings on your regular monthly premiums and put it away in a cost savings account each month towards the amount of the deductible. That method, you have actually got the cash saved up for a higher deductible if you're associated with an accident.

It's crucial to understand what factors are driving the current market due to the fact that they might affect your shopping journey."This also has rental vehicle agencies purchasing used vehicles to preserve everyday need, and holding onto their fleet of lorries for longer than regular, which is minimizing the supply of utilized cars and trucks for sale."So, when is the pre-owned automobile market anticipated to support?

"I honestly don't see an end to the current market demand," states Zoriy Birenboym, CEO of e, Vehicle, Lease. com. "In addition to the chip scarcity, government sanctions are involved and we're concurrently seeing a huge push towards electrical vehicles. It's a best storm of aspects that may keep the marketplace high for rather a long time."Should you buy a used automobile while the marketplace is high? Buying a pre-owned car is a lot more challenging when prices are historically high and there are less vehicles for sale.

Unknown Facts About Do I Need Insurance Before I Buy A Car? - Direct Auto

"If you're a new cars and truck consumer looking at utilized vehicles, truly focus on those Qualified Previously Owned (CPO) cars as they'll supply the most similar features, guarantee and perhaps rewards," states Drury."Drury keeps in mind that SUVs and pickups are the most desired automobiles right now, whether you're purchasing new or used.

If you're wanting to eliminate your current car, now is a fun time to trade it in. "Trade-in worths have actually increased simply as greatly as utilized worths, so you don't desire to leave any cash on the table," states Drury. Rather than buying a brand brand-new car, lots of drivers are taking the lease path.

If you had GAP insurance, it would action in to pay the $1,000 shortage in between what your cars and truck's value is and what you owe. Gap insurance coverage on used car models isn't usually needed. You don't have the drop in value you 'd have when you drive a brand brand-new cars and truck off the lot.

The Single Strategy To Use For Is It Hard To Get Car Insurance For The First Time?

Of all, if you're buying liability insurance coverage, the protection is based around third-party coverages-- the damage you could do to others. More recent automobiles have more security functions that could avoid or minimize mishap damage.

Precise information is a must! Any errors could result in your policy being terminated. 6. Complete payment for your vehicle insurance coverage policy. As soon as your details is submitted, the last step is to spend for your policy. You're all covered and ready to go. Key Takeaway Once you've selected out your automobile, supply your insurance coverage broker with the car's specifications and let them look after the rest.

Nearly all states have requirements as to the minimum amount of automobile insurance you need. If you're caught without insurance, you might be fined or have your license suspended. And if you enter into a mishap with cars and truck insurance coverage, the legal penalties will be more severeeven if you simply purchased your automobile 10 minutes earlier.

Some Of How To Shop For Car Insurance To Get The Best Deal - Business ...

Secret Takeaway Yes, you need insurance coverage before you can drive your brand-new automobile. How quickly after purchasing your car do you need insurance coverage?

Can I get same-day insurance coverage? Yesgetting car insurance isn't as complicated as it appears. It can usually be done Look at more info in 24 hours. Still, it's a good idea to shop around for automobile insurance coverage and compare rates prior to choosing a company. To make the procedure as simple as possible: Assembled basic info, such as the chauffeur's license number and birthday for every single chauffeur who will be using the automobile, Have an excellent idea of what kind of coverage you'll need, Research study insurer, including reviews and scores, to make sure you're selecting the ideal company for youJerry can supply you with competitive quotes from multiple insurance providers in under a minute.

https://www.youtube.com/embed/ovC2OqSV0SY

And to guarantee you always have the most affordable rate, Jerry will send you new quotes every time your policy comes up for renewalso you're always getting the protection you desire at the best price. How do I get insurance prior to buying a used cars and truck? Yes. No matter whether you're buying new or utilized, it's always important to have insurance prior to you hit the road.

AboutThe Greatest Guide To Cheap Car Insurance For Teens & Young Drivers - Obrella

They utilize claims information and individual info, to name a few elements, to examine this risk. In some states, your credit can have some influence on your premium (though California, Massachusetts and Hawaii have all banned the practice of utilizing credit-based insurance ratings to help figure out rates). And while it's somewhat questionable, making use of credit-based insurance scores to affect premium expense is still a reality, with research studies and surveys suggesting that those with less-than-ideal credit are more likely to make insurance claims and vice versa.

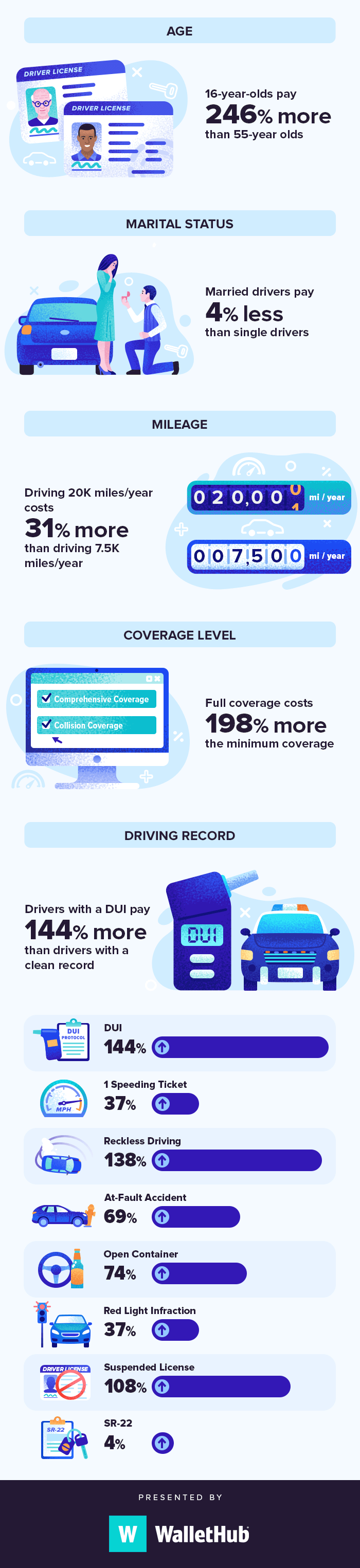

a 2015 Customer Reports survey programs that single participants with just "great" credit paid as much as a tremendous $526 more a year (depending upon their state) than similar chauffeurs with the very best credit history. In addition to credit, your insurance rates may also be impacted by the list below factors: Specific areas have higher-than-normal rates of accidents and vehicle theft.

The smart Trick of Add Teen Car Insurance To Your Policy - State Farm That Nobody is Discussing

The more expensive your automobile is, the higher your insurance coverage rates may be. Insurance providers can also take a look at whether drivers with the same make and design tend to file more claims or remain in more accidents, as well as security test results, cost of repair work and theft rate. Putting fewer miles on your cars and truck every month can impact the rates you get.

Information shows that the possibility of a mishap might be connected to these aspects. Liability insurance coverage generally consists of 3 kinds of coverage: bodily injury liability protection, home damage liability insurance and uninsured driver protection. Each state that needs liability insurance coverage has its own minimum coverage requirement, however you can pick more coverage at a cost. They might all be at danger if you trigger an accident that results in medical or residential or commercial property damage expenses that exceed your protection limit. You may want to select protection limitations that, at minimum, show the worth of your combined properties.

Unknown Facts About Average Car Insurance Costs In 2021 - Ramseysolutions.com

He takes pleasure in offering readers with details that can make their lives happier and mor Learn more. Check out More.

A vehicle insurance coverage policy is an agreement in between the insurance policy holder, generally the vehicle's main chauffeur, and the insurance service provider. The insurance company accepts safeguard the policyholder versus monetary losses laid out within the policy (this is an essential note because if it's not in the agreement, insurance coverage business will not cover it).

The Definitive Guide to Cheap Car Insurance Illinois - Chicago

The premiums are what you pay to keep the policy. Protections are those conditions outlined clearly in the policy, where your insurance coverage business will payment. Exclusions are diplomatic immunities that will nullify your policy, such as driving while intoxicated, avoiding you from getting payments. And the payout is the amount approximately which an insurance coverage service provider will make you entire.

If the insured stops paying premiums, the insurance coverage company will stop protection immediately. If the uninsured driver triggers an accident while driving, then they are personally on the hook for the costs of damages.

Cheap Car Insurance Online - Way for Dummies

Do I get a discount rate if I pay my policy in full? In most states, consumers paying in complete receive discounts.

Sadly, there is something that you probably hadn't depended on when you got your motorist's license, and that is. This can be pricey enough, however if you are a brand-new driver, you are more than likely going to end up paying greater rates than somebody who has actually been driving for a couple of or several years.

About Driversed.com: America's #1 Driver Education Courses Online

There are things that you can do to a little bit. Of course, the very first thing you require to do is go shopping around.

Then you can sit down and take your time to, and find out which business is going to give you the most insurance coverage, at the finest rates. It only takes a few minutes when you request totally free quotes online, and due to the fact that you can be entirely confidential, there will not be any irritating sales individuals calling you later on, attempting to get you to purchase insurance from them (often at greater rates than the initial quotes you got).

2021 Greatest Low Cost Auto Insurance In Alabama – Motley ... - Questions

There are numerous low-cost insurance coverage business out there these days, and they frequently use. Sure, your rates are still going to be higher than the rates of more knowledgeable chauffeurs, however they will still be less than what other larger insurer will charge. Usually, you will get the very fundamental insurance coverage with these types of policies, however this is much better than nothing, and it might be all that you can presently afford.

2Take Motorist's Education and Driver's Training Classes, You can conserve a great deal of cash on vehicle insurance coverage by taking. New drivers are tough to insure because they are not constantly knowledgeable about the rules of the roadway, and they are inexperienced. There are all kinds of things you can find out with these classes, which are focused on making people better motorists.

Facts About Car Insurance For Teens - Nationwide Uncovered

This is going to show insurance coverage business that you do understand what you are doing, and that you are not as much of a threat as other new chauffeurs. It is likewise going to show that you are actually severe about being a safe motorist. 3Get on Your Parents' Insurance coverage, You can save yourself a great deal of cash on auto insurance if you.

As a new driver, you are probably going to be charged higher rates for your insurance coverage than other chauffeurs who have actually been on the roads for years. Here is a brief guide that helps you get all the discount rates you are entitled to: If you do your research, get quotes, take chauffeur's education, have a great working newer vehicle, and even utilize your parent's insurance coverage, you will discover that you can conserve a lot of cash.

Cheapest Car Insurance For First-time Drivers - Wallethub Can Be Fun For Everyone

Being a new chauffeur can be exciting and frightening at the exact same time. As a young and new driver, some of the rates I was priced quote were totally out of my budget plan.

https://www.youtube.com/embed/0zRFR9MrUEE

Here are three pointers for doing just that without sacrificing the kinds of coverage you require to remain safe on the road. One e-mail a day could assist you conserve thousands Tips and techniques from the professionals provided directly to your inbox that could help you save thousands of dollars.

AboutHow Does Car Insurance Cover Medical Bills & Expenses? can Save You Time, Stress, and Money.

It is unlawful for unlicensed insurance providers to sell insurance and, if you purchase from an unlicensed insurance provider, you have no guarantee that the protection you spend for will ever be honored. Read Your Policy Thoroughly, You must be aware that a vehicle insurance coverage is a legal contract. It is written so your rights and responsibilities, as well as those of the insurance provider, are clearly mentioned.

You must check out that policy and ensure you comprehend its contents. If you have concerns about your insurance policy, call your insurance coverage agent for clarification.NAIC Customer Alert:Comprehending Your Vehicle Insurance Coverage. To know what "complete protection vehicle insurance coverage "is, you initially need to understand that there is not truly a true and consistently concurred upon meaning for the term. We know what you're thinking. That can't be the case. In reality, "full coverage car insurance "can mean various things to different people. The truth is, it's simply a saying. Comprehending Complete Coverage Automobile Insurance Coverage Complete protection car insurance coverage isn't a particular kind of insurance coverage. A lot of typically, Full Protection is specified as a combination of coverages consisting of thorough and accident insurance coverage in addition to the liability insurance coverage that is required by the state. You can evaluate coverage definitions in our.

Quickly, liability insurance coverage is the protection that a lot of states need for an automobile to be operated on public streets. It can be used to help spend for damages and injuries to another person and their residential or commercial property when you or a covered insured is deemed to be at fault for an accident. As quickly as the deductible is paid, the insurance company can cover payment for the assessed damage to the insured automobile up to its policy limits. Is Full Protection Total Protection? All of that coverage is excellent, however remember that insurance plan frequently consist of certain limits and exemptions. If you believe that you have complete coverage, you may think that you are protected from things that you really are not. Do not let yourself be captured off guard since you thought you had complete coverage. Take a look at the terms of your.

Some Ideas on When Is The Best Time To Drop Full Coverage Car Insurance? You Need To Know

policy and your Declarations Page to see what particular coverage you have, and what you do not have. Or you can always call among our friendly representatives here at Infinity Insurance coverage by dialing to make certain that you have a policy that fits your needs. Learn how much you can save: What is full coverage automobile insurance? If you're wondering,' what is complete protection cars and truck insurance?', you.

're not alone. As vehicle insurance is distinct to every motorist, there isn't a basic meaning of complete protection vehicle insurance. Typically, full protection auto insurance coverage isn't a specific kind of policy, however rather a combination of liability and physical damage coverage. Available coverage differs from state to state, Safe, Car is here to provide you with complete protection automobile insurance with as many budget-friendly alternatives to keep you covered on the road ahead at a rate that you can pay for. What coverages does Safe, Car deal? At Safe, Automobile, we understand that every driver has their own set of distinct requirements, which is why we provide drivers a variety of coverage options. Bodily Injury and Residential Or Commercial Property Liability Insurance coverage, Bodily injury and residential or commercial property liability insurance are needed in almost every state. Bodily injury and home liability insurance coverage are typically bundled together as a'liability to others 'vehicle insurance coverage type. This type of protection applies to those alarming scenarios where an insured chauffeur causes a mishap that results in physical injury and/or damage to a lorry or home owed by another. What does physical injury cover? Physical injury helps pay for the damages that the insured motorist triggered to another chauffeur or their guests in a crash. This can consist of medical expenditures, earnings loss,

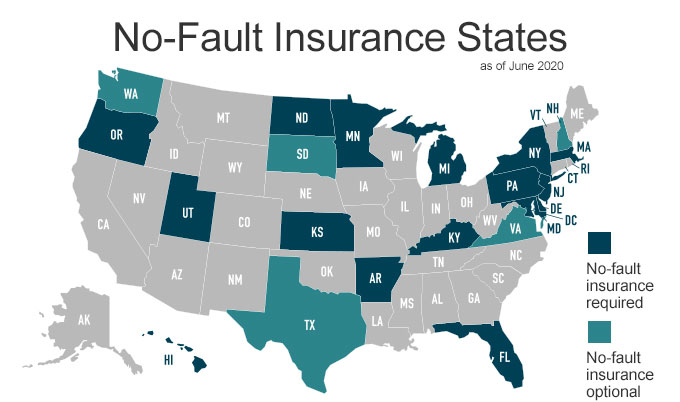

pain and suffering, and more. What does property damage cover? Home damage assists pay for the associated expenses that originate from needing to fix or change property that results from an automobile accident. Additionally, this kind of protection likewise aids the insured chauffeur with a legal defense if the mishap leads to a suit. Personal Injury Defense, In some states that allot for' no fault'vehicle insurance coverage, Injury Protection(PIP)

Some Ideas on What Exactly Does An Auto Insurance Policy Cover? You Need To Know

protection is provided. Accident Protection(PIP) is likewise called first party advantages. Medical and Funeral Costs: Regardless of fault in the mishap, medical expenditures can cover medical expenses and funeral bills that arise from it. This coverage extends to household members and your guests. Loss of Earnings: Loss of earnings covers you if you or others are injured from the mishap, and as a result, can not work. This type of protection assists with child care, house cleaning, lawn work, and more. Physical Damage Coverage: Physical damage coverage apples to the vehicles that are under the cars and truck insurance coverage. Generally, this consists of 2 protection types: crash protection and thorough protection. Crash protection applies to harm that is sustained when an insured automobile collides with another automobile or inanimate object. Automobile Protection Details covers physical injury to other people and damage to the property of others triggered by your negligence or the negligence of somebody driving your vehicle with your approval. A minimum of$25,000 per individual and$ 50,000 per accident for physical injury liability and$25,000 per mishap for property damage liability, is required by law, however drivers are strongly prompted to consider higher limits. This optional coverage changes previously compulsory protection and supplies for medical payments, and in some cases, lost incomes and funeral costs if you or a relative living with you are hurt or eliminated in an accident. covers damage to your vehicle triggered by crash with another vehicle or object or by your cars and truck turning over. Rental compensation pays towards the expense of leasing a vehicle if you have a loss.

covered by either collision or comprehensive protection and your automobile is handicapped. Vehicle insurance coverage covers the costs if you hurt somebody or damage their residential or commercial property with your car. If you get injured in an accident, automobile insurance coverage can likewise cover your medical expenses, and depending on the protection in your policy, it can likewise cover damage to your own car when you are and aren't driving, like if you back into an utility pole or a tree branch falls on your automobile. To use liability coverage, the victim

https://www.youtube.com/embed/mRxfR2ChqNU

, indicating the other chauffeur, will submit a claim with your car insurance, who will work with that person to make sure their damage is spent for . What does personal injury security(PIP )cover? Personal injury security (PIP), also called no-fault protection, helps cover the expenses when you or any of the passengers in your car are injured in an accident. That includes damage from: Crashing into another automobile, Running into a fixeditem, like a tree, Driving over a pothole, What does space insurance coverage cover? When your automobile is stolen or damaged, your car insurance coverage will pay for the actual money value of your vehicle. If you loan or rent your car, and it's totaled in a mishap, you might end up owing more on yourloan or lease than your vehicle's depreciated worth. New car replacement coverage pays to change your amounted to automobile with among a comparable make and model, but it's normally just offered if your cars and truck is less than 2 years old.Rental reimbursement protection: When your vehicle is being fixed in a shop, rental reimbursement protection can spend for a rental cars and truck in the meantime. What does cars and truck insurance not cover? Your automobile insurance policy will tell you what type of mishaps and damage are covered along with what isn't. Vehicle insurance coverage typically doesn't cover: Routine repair work: Repairs that result from regular wear and tear and maintenance issues are not covered, so regular oil modifications or a dripping radiator wouldn't be covered by cars and truck insurance coverage. Consult your insurance provider to see whether you can get protection for your Lamborghini, but you might find you need to patronize specialty insurance providers and get a different policy entirely. Specific hazards: Some reasons for damage are not covered, consisting of intentional damage, damage from street racing or damage from acts of war. Will my insurance coverage increase after a claim? Yes, your automobile insurance coverage rates may go up after a claim. At-fault accidents are nearly ensured to raise your rates, but your insurance can even go up for a not-at-faultclaim. If you find out your rates are going up since of a claim, it might be a great time to reshop your car insurance coverage and see if you can discover more cost effective protection somewhere else. Suing can cause your rates to increase, so if the expense of repairing the damage to your own cars and truck is less than or equal to your deductible, then you should not submit a claim and danger raising your rates. But if another motorist was involved in the mishap, you ought to always alert your insurance coverage companies the other automobile might have more damage than is visible at the scene of the mishap, or the chauffeur may have an injury that isn't apparent till later on. Vehicle insurance coverage protects you financially by paying the other driver's vehicle repair and medical bills if you cause a mishap. Depending on the sort of protection you have, it can likewise pay to repair or replace your vehicle if it's damaged or taken. Texas has a Customer Costs of Rights for auto insurance coverage. Is automobile insurance coverage required? Texas law needs chauffeurs to show proof they can spend for the mishaps they trigger. Most motorists do this by buying car liability insurance. Liability insurance coverage pays to repair or replace the other motorist's cars and truck, or other harmed property, and pays other people's medical costs when you're at fault in a mishap. Discover more: 10 steps to find the ideal car insurance Watch: What type of automobile insurance coverage do you need? Kinds of vehicle coverages There are 8 fundamental vehicle insurance coverage protections. You can select whether to purchase the others. pays to fix the other chauffeur's automobile if you triggered the mishap. Insurance business should offer you this coverage. If you do not desire it, you must inform the company in writing. pays to tow your cars and truck if it can't be driven. It likewise pays for labor to alter a blowout or jump-start your battery. spends for you to lease a car if yours is taken or being fixed after an accident. This table reveals some of the important things most policies do and do not cover. Read your policy or talk to your representative to be sure of your exact protections. What policies cover A lot of policies cover: Most policies don't cover: Damage to your automobile because of fire, hail, theft, flood, flying gravel, or hitting an animal (if you have thorough protection)Mishaps that take place while you're driving for a ride-hailing service or delivering food or other products for a fee Accidents that take place while you or somebody covered by your policy is driving a rental car Accidents that take place while you're driving a car that does not come from you but you could use frequently, like a company-owned cars and truck Mishaps that happen while you're driving in other states and Canada Equipment temporarily installed in your car Your attorneys'costs if you're taken legal action against since of an accident Mishaps that occur while you're driving in Mexico, driving for organization, or racing Cars and truck repair work, lost salaries, and medical and funeral expenses to the other chauffeur and passengers if you trigger a mishap Damages that you triggered deliberately What takes place if I purchase a new cars and truck? Is it covered? If you get a brand-new automobile, your current insurance coverage will automatically cover it for about 20 days. gets the very same protection as the vehicle with the most coverage on your policy. gets the same protection as the automobile it changes on your policy. Tell your business about a brand-new cars and truck as soon as you can to avoid a lapse in protection. Am I covered if I'm driving somebody else's vehicle? Rental companies use damage waivers and liability policies. Find out more: Do I require to buy insurance coverage when I lease a car? If you cause a mishap while driving a borrowed car, the automobile owner's insurance coverage pays claims. If the owner does not have insurance, or does not have enough to spend for the damages and injuries you caused, your insurance coverage will pay. Liability, individual injury security, uninsured/underinsured vehicle driver, towing and labor, and rental coverages have dollar limitations. This is the most the business will pay, even if the cost is greater. If you don't have adequate protection, you'll need to pay the difference yourself. Accident and thorough coverages don't have dollar limits. It has a summary of your policy, including your coverages, dollar limits, and deductibles.

AboutOur Mistakes To Avoid When Buying A Car For A Teen - Liberty Mutual Diaries

In the small cars category, Subaru, XV Crosstrek 2. 0I is one of the very best cars and trucks for teens in terms of safety. You can think about purchasing it, if you are not on a tight budget. When it comes to buying the very best used vehicles for teenagers make sure to check its security ratings.

ESC was needed as basic devices on automobiles beginning in 2012. ESC helps chauffeurs restore control of a vehicle throughout a slide and can be a genuine lifesaver. According to Anne Mc, Cartt, senior vice president for research at the IIHS, ESC is a must. "Parents ought to never consider any lorry that does not have electronic stability control," she stated.

The 15-Second Trick For Car Insurance For Young Drivers And Teens - Usaa

Insurance coverage rates can be expensive, but there are methods to conserve money on your automobile insurance. We have actually come up with a list of the best cars and trucks to guarantee for your teen driver.

"Parents need to look for a boring, utilized vehicle with lots of safety features. You desire a vehicle that the teenager isn't going to drive beyond their abilities. Sedans are popular options for newbie drivers.

Examine This Report on Teen Driving - Nhtsa

These depressing statistics are a major reason for your impending premium increase. "Parents will typically see their car insurance costs double when including a teen," states Gusner. Among the most significant questions moms and dads have when it comes to vehicles for teens and insurance coverage is whether they need to put the teen on their policy or get the teenager their own policy, if that is even an option.

An insurance coverage is considered an agreement which features legal ramifications. In order to legally sign an insurance plan, an individual needs to have reached the "age of majority."This is the age that the state you reside in considers a child to have become an adult. When an individual reaches the age of bulk they can consent to medical treatment, sign a contract, and do everything else a grownup can lawfully do.

3 Easy Facts About Info For Parents, Teen Drivers And Their Passengers - Ct.gov Described

There are a number of states that have pressed the age of majority even higher. Alabama and Nebraska put their age of bulk at 19. All of this indicates that in many situations, putting a teenager by themselves policy is not an alternative unless they are at least 18.

We ran the numbers and including a 16-year male to a parent's full protection policy will push your premium as much as $1,934. The pain is somewhat less when including a female of the very same age, your premium will only go up $1,592. While this is certainly a huge increase, it pales in contrast to putting a teenager on their own policy.

Some Known Details About Tips For Saving With Teen Driver Discounts - Bankrate

We put together a whole list of safe new cars and trucks that are cost effective to insure, however here are a few examples of some of the safest automobiles for teenagers that are brand brand-new and will not clear your checking account to guarantee. When it comes to little cars, they are all more economical to guarantee than the national average.

A few methods for insurance coverage and automobiles for teens, When it concerns insurance and new motorists there are a couple of choices for moms and dads: This is most likely the most common and best method to handle a new chauffeur. While including a teenager to your policy can quickly push your insurance costs up anywhere from 100% to 200%, it is typically the most inexpensive and most practical choice.

What Does Best Cars For Teens: The List Every Parent Needs - Kelley ... Do?

This is typically a pretty expensive alternative but if you have the budget it can be an excellent choice. A newer lorry will come with lots of safety functions, however your insurance costs will absolutely go up. If you are considering this option make certain to get insurance quotes on any car you are considering so there are not a surprises when it comes time to put a policy in location.

There are plenty of inexpensive cars for teenagers readily available and putting them in a beater may make sense. A low-cost older car might reduce your insurance premium, however the vehicle will lack the most recent safety features.

Car Insurance Information For Teen Drivers - Geico - Questions

If your teenager is old enough to sign a contract (18 in a lot of states) you might desire to put them in a beater and on their own policy. This is never going to be the most inexpensive choice, putting a teen by themselves policy is generally more expensive than including them to your policy, presuming they do not have many tickets or mishaps.

This indicates that there will be zero insurance protection if your teen joyrides your car so make certain they understand they can not drive your cars under any circumstances. Safety and car Insurance coverage tips for teenager drivers, Once a teen hits your policy there is no other way to avoid the discomfort of a significant rate boost.

Some Ideas on Best Cars For Teenagers - Top 10 - Motors.co.uk You Need To Know

Most come with some kind of discount rate when your teen finishes the course."Ask your insurance company if there are discounts for a motorist's education course or if they have a teenager program," states Gusner. State Farm has Steer Clear, Safeco has Right, Track, and American Family has a Teen Safe Driver Program."These programs generally involve driving training through an app as well as monitoring their driving by means of the app or a plug-in device.

If your teenager has actually been trained on how to deal with less than perfect circumstances out on the roadway it must lessen their chances of entering a mishap, which is music to an insurance company's ears. Consult your insurance company to see if they offer a discount for completing a defensive driving course.

The Single Strategy To Use For Teen Driving - Nhtsa

Doubling your deductible can shave 10 to 20 percent off of your premium. Constantly select a deductible that you can manage in case you need to make a claim on your policy. If you bring a range of policies with your insurer you should be getting a bundling discount.

Bundling can be a substantial money saver, approximately 25 percent," says Gusner. As soon as Junior is all set to avoid to college you might be able to decrease your premium, specifically if they are headed to a college over 100 miles away and will not be taking a car with them."When your teenager avoid to college, you might be eligible for lower premiums, supplied the car remains behind.

5 Easy Facts About Should You Add Your Teen Driver To Your Car Insurance ... Shown

What is the very best starter car for a teenager? One with a lot of safety features, It is always appealing to put a teenager in an old cars and truck and save a bit of coin but that can be an error. New cars (or newish ones) come with strong safety rankings, as well as sophisticated safety features which can assist prevent accidents.

When the car remains in reverse, backing out of a parking area or driveway, this system will send out an audible alert if another car is discovered crossing the lorry's rear course. This can help teens prevent a mishap and an expensive claim. A blind area caution system keeps an eye on the blind spots of the automobile and will notify the motorist if a lorry enters their blind spot.

Teen Driving - Nhtsa Fundamentals Explained

https://www.youtube.com/embed/j1nqzXVl-VY

An effective engine and a hankering for speed make these automobiles a recipe for disaster when it comes to teen motorists. Stay with an uninteresting sedan with a small engine. If your teenager remains in an accident the bigger the cars and truck, the better the outcome. This does not suggest you have to put your teen in a Hummer, simply prevent the tiniest cars and trucks and consider opting for a midsize or above if possible.

AboutThe Of Should You Buy Gap Insurance For Your New Car? - Edmunds

What is depreciation? As quickly as you drive a new automobile off the sales lot, it immediately declines, or diminishes. While the depreciation rate depends on the year, make and model, on average, your car deserves 20% less than the initial worth simply one year after you've acquired it.

This indicates that if you've taken out a loan, you might owe back more money than your car deserves. Enter: Space coverage Got it so far? Okay, here's how it works: If you enter into an accident and your car is harmed beyond repair work, your average comprehensive and accident policy will just cover the diminished value.

Your insurance will cover the depreciated worth, which might be 20% less than what you paid for the car. Now, you're stuck making payments on a vehicle that you can't even drive.

What Is Gap Insurance: Everything You Need To Know - Kelley ... for Dummies

Talk to your independent representative Now that you've got the basics down, your independent insurance agent will fill you in on the rest, like protection limits and requirements. There are also some instances in which you may currently have gap insurance protection. If you're leasing your cars and truck, space insurance may already be consisted of in your contract and your lease payments.

Space insurance coverage is a type of car insurance coverage that covers the difference in between your loan balance and the existing value if your cars and truck is amounted to or stolen. is a should for every single driver, however many individuals are unsure of whether additional policies such as GAP insurance coverage are needed. GAP means Guaranteed Property Defense, and while space insurance may not be for everybody, it can be an extremely important coverage to have in specific situations.

GAP insurance described GAP insurance is a that assists cover your automobile in case of an accident where an automobile is amounted to, or in case of a car theft. It provides coverage by paying the distinction between what is received for a total loss or theft from the standard automobile insurance plan, and what is still owed on the cars and truck.

What Is Gap Insurance? - Insurance Options - Garavel Cjdr Things To Know Before You Buy

For instance: Let's state you have a balance of $25,000 on your existing car loan. However, based upon depreciation your car is only worth $20,000. If you're included in a mishap or if your automobile is stolen, your automobile insurance policy will repay you for the $20,000, because that is what your cars and truck deserves.

Where to buy GAP insurance coverage Many car dealers offer Space insurance. They make it easy to purchase protection when you acquire your vehicle, and typically roll the insurance coverage premium into your month-to-month vehicle payment.

In reality, there are lots of states where insurers automatically include space coverage when you purchase a new car, so make certain to examine with your agent to see if you're currently covered. If you're not, then the coverage could be "endorsed" onto your policy for a reasonable premium. Another benefit to acquiring space insurance coverage with the very same company as your primary automobile insurance coverage is that you will only need to submit a single claim in case your vehicle is an overall loss instead of requiring to file two claims-- one with your main insurance provider and the other with your space insurance company.

The Only Guide to What Is Gap Coverage? - Bill Luke Santan

The first thing to think about is just how much you owe on your vehicle loan and if that amount goes beyond the value of your automobile. If it does, and the difference is large enough that it would be a monetary problem for you to repay to your financing business expense, then GAP insurance is probably an excellent choice for you.

For the most part space insurance coverage is reasonably economical and getting it can conserve you a great deal of money and stress if a significant mishap or theft ought to occur. For more details about other Protective products, visit our Possession Security page.

Space insurance coverage is normally very affordable to contribute to an insurance coverage policy. Including this kind of insurance coverage can secure you from having to pay the distinction between your loan quantity owed and ACV. If you owe $14,000 on your cars and truck loan and your car's ACV is $10,000, you'll have to cover the $4,000 gap between what you owe and your vehicle's value.

The 9-Minute Rule for Products :: Total Loss Protection Plan (Gap) Waiver - Fidelity ...

Gap insurance isn't a state requirement, however this add-on insurance can be handy in certain scenarios. In some cases, a lender or lienholder might require you to purchase gap insurance as one of the conditions for the car loan.

The unfortunate reality is that people frequently put down less than that. In fact, an Edmunds analysis in 2019 found that the average vehicle loan deposit was 11. 7 percent. Space insurance coverage can protect you when it comes to the total loss of your car within the first number of years if you put down less than 20 percent as a deposit.

Funded For 48 to 60 Months or Longer, Long-term funding gives you plenty of time to settle your vehicle loan. Customers with long-lasting financing make lower month-to-month payments but are also left upside-down on their loans for longer. Vehicle loan terms longer than four years leave a considerable amount of time for you to be undersea on your loan.

The Definitive Guide to Total Loss Protection (Gap) - Hertz Car Sales

Sometimes, space insurance coverage is included in the lease, however not constantly. Even Helpful site if your loan provider doesn't need space insurance coverage, you may wish to consider it. Purchased Car That Diminishes Quicker Than Average, The average vehicle diminishes at a quick rate, however some cars and trucks depreciate even much faster. It is necessary to think about the design and make of your vehicle prior to acquiring a brand-new or pre-owned automobile.

Individuals That Drive A Lot, Higher mileage on your odometer implies that your cars and truck's value will depreciate faster than others. If you drive more than 15,000 miles each year, you might desire to buy space insurance coverage to secure you when it comes to a complete cars and truck loss. You Will not Be Able to Cover the Gap Expense, If you're associated with a mishap where your vehicle can't be changed and you still owe money on your automobile loan, gap insurance coverage covers the difference between your vehicle loan quantity and ACV, implying the space insurance compensation will pay the car lending institution to settle your loan.

https://www.youtube.com/embed/b1JSBxoI5z4

Even if you have terrific protective driving abilities, others might not. Is your cars and truck liable to be taken? Gap insurance can cover you in case of theft or natural disasters such as typhoons, wildfire, flooding, and more. Gap insurance includes defense on top of your detailed and accident insurance coverage. Comprehensive and accident insurance will pay up to the current market price of your cars and truck.

AboutThe Only Guide for How Long Does It Take To Get Car Insurance - Policygenius

Did you understand Maryland is a mandatory car insurance state? What does this mean for you? MDOT MVA now validates your car insurance coverage at registration renewal. You can with MDOT MVA anytime on our e, Services Website. In order to register your car in Maryland you need to have liability insurance coverage.

3. If you have actually moved out of state and did not return your license plates, it is crucial for you to alert the MVA and supply the following info: Copy of registration from the state in which the car is currently entitled Date the lorry was entitled in the present state Maryland tag and title number If you have actually not yet entitled your lorry out of state, you should have yourvehicle insurance business provide us with policy info detailing the reliable and termination dates.

Failure to respond to MVA insurance notifications will result in your case being moved to the Central Collections System (CCU). As soon as your case is sent to CCU, fines undergo a 17% collection cost and your income tax return will be intercepted. Here are the facts about automobile insurance in the State of Maryland.

The smart Trick of How Long Does A Car Insurance Claim Take To Settle? - Hi ... That Nobody is Talking About

To get more information on how to insure your vehicle, click here to visit MAIF's site. Did you get an offense for not having insurance coverage? What should I do if I was associated with a mishap with an uninsured driver?.

Whether you're relocating to another state, purchasing a brand-new lorry or merely trying to find better automobile insurance protection, you may wish to switch your car insurance coverage. Even if you are simply moving to a new ZIP code in the same city, for example, changing your vehicle insurance could be numerous dollars cheaper.

Your city, state and even your ZIP code may affect your automobile insurance premium. If you are moving, it might be an excellent time to think about a new vehicle insurance provider to at least see if rates are more competitive because area. If your teenager is about to get a license or you are including a new car to your household, think about getting quotes from other insurance coverage carriers.

The Best Guide To Sr-22 Insurance And How It Works - Dairyland® Auto

Eventually, the more coverage you include to your cars and truck insurance policy, the more it will cost. Check for prospective penalties, If you decide that changing your car insurance is the right option, you may desire to find out if there are any charges, like a cancellation fee, for changing vehicle insurance coverage business before the end of the protection duration.

But if you can find a brand-new policy with a premium that makes up for any cancellation charges charged by your old carrier, it may still make financial sense to change companies. 3. Compare automobile insurance coverage quotes from numerous providers, If you have decided it's an excellent time to alter carriers, the first thing you may want to think about doing is getting quotes from a number of various auto insurance providers.

Just make sure you are getting quotes for the exact same coverage, so you are comparing apples-to-apples premiums. Whether you are getting quotes online, by phone or at a company, you'll likely require to be prepared with some basic information: Address where the automobile will be kept Vehicle year, make and design Automobile Identification Number (VIN) Chauffeur's license or Social Security number (car insurers will use this details to evaluate your motor car record and any other personal factors that might affect your premium, such as your credit-based insurance coverage score in some states) As you are researching companies, you can likewise examine available discount rates.

4 Simple Techniques For Nine Ways To Lower Your Auto Insurance Costs - Iii

AM Best rates business with letter grades based upon many financial procedures, which can suggest a company's ability to pay out claims in a prompt fashion. Normally, you need to strive to be insured by a business that has an AM Best monetary strength rating no lower than an A- (Outstanding).

Even if you are not at fault, the majority of states need insurance provider to submit evidence of insurance with the Department of Motor Vehicles after an accident if cops are called. If you do not have car insurance coverage, your chauffeur's license might be suspended. Driving without insurance coverage could trigger insurance companies to charge you greater premiums in the future because they might subsequently view you as a high-risk chauffeur.

: Contact your current insurance business and alert them that you are terminating your policy. This will avoid them from billing you for future coverage.

Some Known Incorrect Statements About Free Car Insurance Quote - Save On Auto Insurance - State ...

Do vehicle insurer refund premiums I currently paid? Your car insurer will be needed to reimburse any unearned premium; nevertheless, it might charge a cancellation charge to cover administrative expenses of canceling the policy, particularly if you are canceling in the middle of your policy term. You might wish to call your company or insurance representative to make certain you understand its insurance coverage cancellation policy.

Insurance Coverage Compliance - Frequently Asked Questions Connecticut law requires that any motor vehicle registration that has not been canceled should have liability insurance.

Action must be taken by the DMV if this declaration is not honored. Whenever insurance coverage is cancelled, the DMV is informed by the insurer and the registrant is mailed a Caution Notice using the opportunity to participate in a permission agreement, acquire insurance, and pay a fine of $200.

5 Simple Techniques For Florida Insurance Requirements

Failure to comply with the suspension notice will result in suspension of the automobile registration & the registration advantage of the registrant. At that time, a hearing may be asked for. An unfavorable choice following an administrative hearing will result in: Suspension of registration Loss of all privileges to restore or register ANY automobile Maintain liability insurance if you intend to operate your car and have active registration plates.

https://www.youtube.com/embed/EEV9ekappoU

Be sure to keep thorough protection during that time which reduces your insurance coverage rate and keeps your vehicle from being reported. At that time, you might then drop all insurance coverage on the vehicle.

AboutNot known Details About How Much Does Insurance Go Up After An Accident?

Ensure you ask the business about this to see if you qualify. There's no harm in making a case for yourself, particularly if you are a design client with an excellent driving record. Here are some companies that provide mishap forgiveness programs to insurance policy holders: The length of time does an accident remain on your record? Many mishaps remain on your record for 3-5 years.

The specifics depend upon your state and how severe the mishap was. For example, in Washington State, a traffic mishap will remain on your record for 5 years. In New York, it's 3 years. A DUI will stay on a New York chauffeur's record for 15 years. Your driving record can be accessed by insurance provider, the DMV, and the police department.

While you can't hide your record, you may have the ability to discover a company that can beat your brand-new rate with your old provider. How to reduce your automobile insurance coverage rates after a mishap As soon as you have actually recuperated from the mishap, it's time to look at your rates. Examine into mishap forgiveness.

Rumored Buzz on How Long Does A Car Accident Affect My Insurance Rates?

You might certify for bundling discounts, a paperless discount, a great trainee discount, a telematics safe driving discount, and more. Drive a various cars and truck. More pricey vehicles tend to be more pricey to guarantee.